The “Laffer Curve” is an accepted portrayal of the law of diminishing returns caused by higher taxes. But its misuse also explains our dismal economy.

Here is the Wikipedia description of the Laffer Curve:

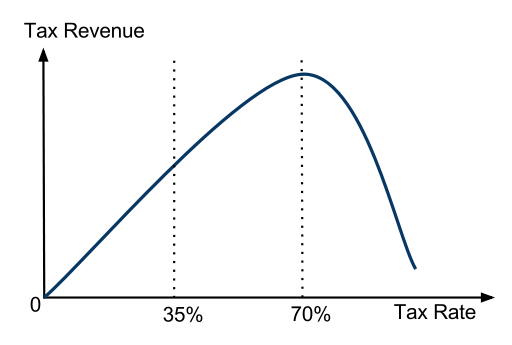

In economics, the Laffer curve is a theoretical representation of the relationship between government revenue raised by taxation and all possible rates of taxation. It is used to illustrate the concept of taxable income elasticity (that taxable income will change in response to changes in the rate of taxation). The curve is constructed by thought experiment. First, the amount of tax revenue raised at the extreme tax rates of 0% and 100% is considered. It is clear that a 0% tax rate raises no revenue, but the Laffer curve hypothesis is that a 100% tax rate will also generate no revenue because at such a rate there is no longer any incentive for a rational taxpayer to earn any income, thus the revenue raised will be 100% of nothing. If both a 0% rate and 100% rate of taxation generate no revenue, it follows that there must exist at least one rate in between where tax revenue would be a maximum. The Laffer curve is typically represented as a graph which starts at 0% tax, zero revenue, rises to a maximum rate of revenue raised at an intermediate rate of taxation and then falls again to zero revenue at a 100% tax rate. However, there are infinitely many curves satisfying these boundary conditions. Little can be said without further assumptions or empirical data.

One potential result of the Laffer curve is that increasing tax rates beyond a certain point will become counterproductive for raising further tax revenue. A hypothetical Laffer curve for any given economy can only be estimated and such estimates are sometimes controversial. The New Palgrave Dictionary of Economics reports that estimates of revenue-maximizing tax rates have varied widely, with a mid-range of around 70%.[2]

Here is the traditional portrayal of the Laffer Curve:

Note the high tax rate (70%) that is portrayed as the “optimal” tax revenue-generating rate before the point of diminishing returns is reached. That may be the result in a vacuum, as if the United States is the only nation that existed.

However, the reality is other nations exist. Other nations compete for the manufacture and sale of goods and services. Other nations may have and do have lower tax rates than we have. So, while in a vacuum we may be able to reach 70% as the optimal tax rate for generating the most revenue, international competition makes that tax rate impractical and counterproductive.

If we are competing with countries that tax their manufacturing sector at only a 20% or 30% rate, we cannot compete with a 70% tax rate, everything else being equal. If we can’t compete with the theoretically “optimum” 70% rate, it stands to reason that our “optimum” tax rate needs to be lower. The stock Laffer Curve that makes the rounds showing an optimum 70% tax rate is not just misleading but overly simplistically ignores the impact of world wide competition.

A more accurate Laffer Curve which takes international competion into consideration would also consider the lower tax rates of our competion. For example, instead of assuming an optimum US tax rate of a 70% as shown in blue, we might need to consider the optimum rate closer to 40% or less as shown in red.

Looking at the red line, which assumes competition, if the tax rate remained at 70%, tax revenues would be significantly less than if tax rates were at 40%.

Of course, there are myriad other factors in addition to tax rates that compound the complexity of competition, not the least of which is the cost of environmental regulations. The greater the cost to business of environmental reguilations, the lower the tax rate needs to be, all things being equal. With the level of environmental regulations we have in this country, the tax rates need to be much lower than they are now for our business to remain competitive in world markets. Given our excessive regulatory climate, our tax rates might need to be closer to 20 or 30% or less for us to be sustainably competitive.

Is there any wonder why we ship so many jobs overseas and have such a small and continually shrinking manufacturing sector?

No comments:

Post a Comment